When it comes to managing finances in the hospitality industry, precision and accuracy are paramount. Every penny counts, and the ability to seamlessly handle financial transactions, budgets, and assets can make or break a hotel's success. Enter Dynamics 365 Business Central, the robust ERP solution, and LS Central, a powerful addon tailored for hotel management. Together, they form a dynamic duo that simplifies and enhances financial management for hotels of all sizes.

Dynamics 365 Business Central: Your Financial Backbone

Overview of Financial Management in Business Central

Dynamics 365 Business Central serves as the financial backbone for hotels, offering a comprehensive suite of financial tools designed to streamline operations and ensure financial health. Here's a closer look at what Business Central brings to the table:

General Ledger and its Role in Hotel Accounting

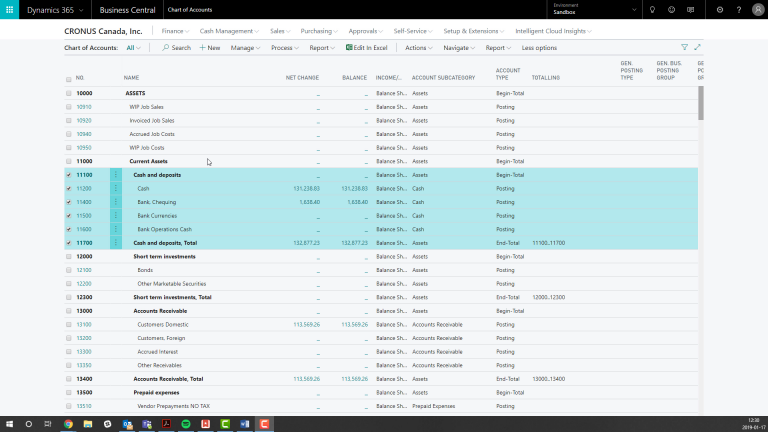

The General Ledger is a fundamental accounting tool used by hotels and businesses to record, organize, and track all financial transactions. It serves as a central repository for financial data, providing a comprehensive view of a company's financial health. Here's a breakdown of its role in hotel accounting along with examples:

Role of General Ledger in Hotel Accounting:

- Recording Financial Transactions: The General Ledger records all financial transactions that occur within a hotel. This includes revenue generated from room bookings, restaurant sales, banquet events, and other services, as well as expenses like staff salaries, utilities, and maintenance costs.

- Categorizing Transactions: Transactions are categorized into various accounts within the General Ledger. These accounts represent different aspects of the hotel's financial activities, such as revenue accounts, expense accounts, asset accounts, and liability accounts. For example:

- Revenue Accounts: Room Revenue, Food and Beverage Sales, Spa Revenue

- Expense Accounts: Salaries and Wages, Utilities, Marketing Expenses

- Asset Accounts: Cash, Accounts Receivable, Property and Equipment

- Liability Accounts: Accounts Payable, Loans Payable, Accrued Liabilities

- Maintaining Accuracy: The General Ledger ensures accuracy and consistency in financial recording. Every transaction is recorded with supporting details, such as dates, descriptions, and amounts, making it easy to trace and verify entries.

- Tax Compliance: Accurate and well-maintained General Ledger records are essential for tax compliance. Hotels must report their income and expenses to tax authorities accurately to fulfill their tax obligations.

- Financial Reporting: The data stored in the General Ledger serves as the foundation for financial reporting. Hotels use this information to create financial statements, including the income statement (profit and loss statement) and the balance sheet. These reports offer insights into the hotel's financial performance and financial position.

Budgets and Financial Planning

Dynamics 365 Business Central provides robust tools to assist hotels in creating, managing, and optimizing their budgets, helping them maintain fiscal responsibility and make informed financial decisions.

Budgeting in Hotel Financial Management:

- Setting Financial Goals: Budgets serve as roadmaps for a hotel's financial journey. They allow hotel management to establish clear financial goals and objectives for a specific period, typically a fiscal year. These goals can include revenue targets, cost containment measures, and profit margins.

- Expense Allocation: Budgets allocate resources and expenses to various departments and functions within the hotel. This process involves estimating the expected costs associated with areas like room operations, food and beverage services, marketing, maintenance, and more.

- Revenue Projections: In addition to expense planning, budgets project expected revenue streams. This can include estimates for room bookings, restaurant sales, banquet events, and any other sources of income. Accurate revenue projections are crucial for aligning expenses with expected revenue.

- Tracking Progress: Dynamics 365 Business Central allows hotels to track their financial progress against the budget in real-time. This monitoring provides immediate insights into whether the hotel is on track to meet its financial goals or if adjustments are needed.

- Expense Control: Budgets help control expenses by setting predefined limits for each department or category. If a department exceeds its allocated budget, it triggers a review process to identify cost-saving measures or reallocation of resources.

- Informed Decision-Making: By regularly reviewing budget versus actual performance, hotel management can make informed decisions. If a department is consistently underperforming or exceeding its budget, adjustments can be made to improve profitability and financial stability.

- Financial Reporting: The budgeting process generates financial reports that compare actual performance to the budgeted figures. This allows for variance analysis, highlighting areas where the hotel exceeded or fell short of its financial targets.

Dynamics 365 Business Central and Hotel Financial Management:

Dynamics 365 Business Central is a comprehensive enterprise resource planning (ERP) solution that is highly adaptable to the needs of the hospitality industry, including hotels. Here's how it supports hotel financial management and budgeting:

- Efficient Budget Creation: Business Central simplifies the budget creation process by providing user-friendly budgeting tools. Hotels can set up budgets for revenue and expenses, specifying details for each department or cost center.

- Real-time Tracking: Business Central offers real-time monitoring of financial data, allowing hotels to compare actual performance with budgeted figures as transactions occur. This enables quick course corrections if needed.

- Data Integration: Business Central seamlessly integrates with other hotel management software, such as LS Central, to ensure that financial data is consistent and up-to-date across all systems. This integration eliminates data silos and enhances the accuracy of budgeting and financial planning.

- Customized Reporting: The solution offers customizable reporting capabilities, enabling hotels to generate budget performance reports tailored to their specific needs. This aids in decision-making and supports financial transparency.

- Data Analytics: Business Central incorporates data analytics tools that provide insights into financial trends, helping hotels make data-driven decisions and refine their budgeting strategies.

Budgeting is a critical aspect of hotel financial management, and Dynamics 365 Business Central empowers hotels to create, manage, and optimize budgets efficiently. By using this ERP solution in conjunction with hotel management software like LS Central, hotels can enhance their financial planning processes, improve fiscal responsibility, and ultimately achieve their financial goals.

Managing Fixed Assets

Managing fixed assets is crucial for hotels to ensure that their valuable physical assets, such as furniture, kitchen equipment, and property, are effectively tracked, maintained, and optimized. Dynamics 365 Business Central provides a comprehensive solution for managing fixed assets in the context of hotel financial management. Here's an explanation:

Managing Fixed Assets in Hotel Financial Management:

- Asset Tracking: Hotels own a wide range of fixed assets, including furniture, fixtures, kitchen equipment, vehicles, and real estate properties. Dynamics 365 Business Central allows hotels to record and track these assets efficiently. Each asset is assigned a unique identification number and is categorized based on its type and location.

- Depreciation Management: Fixed assets have a limited useful life, and their value decreases over time due to wear and tear. Business Central automates the calculation and tracking of asset depreciation, ensuring compliance with accounting standards. Depreciation schedules can be set up to spread the asset's cost over its useful life.

- Maintenance Scheduling: Regular maintenance is essential to extend the lifespan of fixed assets and prevent unexpected breakdowns. Business Central enables hotels to schedule and track maintenance tasks for each asset. This helps in preventing costly repairs and downtime.

- Asset Valuation: Accurate valuation of fixed assets is crucial for financial reporting and decision-making. Business Central provides real-time asset valuation, taking into account depreciation and any changes in the asset's condition or market value.

- Disposal and Replacement: When fixed assets are no longer in use or become obsolete, hotels can record their disposal or replacement in Business Central. This ensures proper accounting treatment and helps hotels plan for new asset acquisitions.

- Compliance and Reporting: Business Central supports compliance with accounting and tax regulations by generating accurate and audit-ready fixed asset reports. These reports provide insights into the financial health of the hotel and aid in tax planning.

Dynamics 365 Business Central and Fixed Asset Management:

Dynamics 365 Business Central streamlines fixed asset management for hotels in several ways:

- Automated Depreciation: The system automates the calculation of asset depreciation, reducing manual work and the risk of errors. Hotels can choose from different depreciation methods to align with accounting standards.

- Maintenance Alerts: Business Central allows hotels to set up maintenance schedules and sends alerts when maintenance tasks are due. This proactive approach helps prevent asset breakdowns and extends asset lifespans.

- Asset History: The solution maintains a detailed history of each asset, including its acquisition date, maintenance records, depreciation history, and disposal information. This historical data is valuable for financial reporting and decision-making.

- Integration with Financials: Business Central seamlessly integrates fixed asset data with the general ledger and financial reporting. This ensures that asset-related transactions are accurately reflected in the hotel's financial statements.

- Cost Control: Effective fixed asset management helps hotels control costs associated with maintenance and replacements. By optimizing asset lifecycles, hotels can allocate their resources more efficiently.

In summary, Dynamics 365 Business Central plays a vital role in helping hotels manage their fixed assets effectively. This includes tracking depreciation, scheduling maintenance, and ensuring accurate asset valuations. By leveraging Business Central's capabilities, hotels can maximize the lifespan and value of their fixed assets, contributing to the overall success and financial stability of the hotel.

Streamlining Account Schedules

Streamlining account schedules is an essential aspect of hotel financial management. Dynamics 365 Business Central offers powerful tools for creating and managing account schedules, which aid in generating insightful reports and financial statements, enabling hotels to analyze their performance and plan for the future effectively.

Streamlining Account Schedules in Hotel Financial Management:

- Structured Financial Data: Account schedules serve as a structured framework for organizing financial data within Dynamics 365 Business Central. They define how financial information should be presented, helping hotels maintain consistency in financial reporting.

- Customized Reporting: Business Central allows hotels to customize account schedules to match their specific reporting needs. This customization can include selecting the accounts to include in the schedule, defining calculation methods, and setting up date ranges.

- Insightful Reports: Account schedules are used to generate a variety of financial reports, such as income statements (profit and loss statements), balance sheets, cash flow statements, and more. These reports provide a clear overview of the hotel's financial performance.

- Comparative Analysis: By creating account schedules with comparative periods (e.g., month-over-month or year-over-year), hotels can perform in-depth comparative analysis. This enables them to identify trends, anomalies, and areas for improvement.

- Budget vs. Actual Analysis: Account schedules facilitate budget vs. actual analysis by comparing the budgeted figures with actual financial results. This analysis helps hotels evaluate their financial performance against their financial goals.

- Forecasting: Account schedules can be used in forecasting future financial performance based on historical data and expected trends. This aids in long-term financial planning and decision-making.

- Drill-Down Capabilities: Business Central allows users to drill down into account schedule reports to view transaction-level details. This level of detail is valuable for investigating discrepancies or analyzing specific transactions.

Dynamics 365 Business Central and Account Schedules:

Dynamics 365 Business Central simplifies the process of creating, managing, and utilizing account schedules for hotel financial management in the following ways:

- User-Friendly Interface: The system provides a user-friendly interface for setting up and customizing account schedules. Hotels can easily define the structure and content of their financial reports.

- Integration with Financial Data: Account schedules are seamlessly integrated with the general ledger and other financial data within Business Central. This ensures that the reports are based on accurate and up-to-date financial information.

- Real-Time Reporting: Business Central offers real-time reporting capabilities, allowing hotels to generate account schedule reports on-demand and access the latest financial data instantly.

- Export and Sharing: Hotels can export account schedule reports in various formats, such as PDF or Excel, for easy sharing with stakeholders, including management, investors, and auditors.

- Visibility and Transparency: Account schedules enhance financial visibility and transparency by providing a standardized format for financial reporting. This is especially important for hotels with multiple properties or locations.

In summary, Dynamics 365 Business Central empowers hotels to streamline their account schedules, making it easier to generate insightful reports and financial statements. These reports enable hotels to analyze their financial performance, conduct comparative analysis, and plan for the future effectively. By leveraging the customization and integration capabilities of Business Central, hotels can maintain financial transparency and make informed decisions to drive their success.

Cash Flow Forecasting for Hotels

Cash flow forecasting is a critical component of financial management in the hospitality industry. Dynamics 365 Business Central offers valuable cash flow forecasting tools that enable hotels to predict cash inflows and outflows effectively, ensuring they always have the necessary funds to operate smoothly.

Cash Flow Forecasting for Hotels:

- Essential for Liquidity: Cash flow forecasting is essential for hotels to maintain liquidity. It helps hotels anticipate the timing and amount of cash inflows (revenue) and cash outflows (expenses) with precision.

- Budget Planning: Cash flow forecasts are integral to the budget planning process. By accurately predicting cash flow, hotels can align their budgets with expected cash availability, preventing cash shortages or excess idle funds.

- Operating Capital: Hotels require adequate operating capital to cover daily operational expenses, such as payroll, utility bills, and inventory purchases. Cash flow forecasting ensures that hotels have sufficient funds to meet these obligations.

- Debt Management: For hotels with loans or credit lines, cash flow forecasting helps in managing debt obligations. It ensures that scheduled loan payments can be made without disrupting daily operations.

- Emergency Planning: Unexpected expenses or revenue shortfalls can occur in the hospitality industry. Cash flow forecasts allow hotels to plan for emergencies by setting aside contingency funds or securing backup financing.

- Investment Decisions: Hotels may consider investment opportunities, such as property renovations or expansions. Cash flow forecasting assists in evaluating whether the hotel can afford such investments without compromising daily operations.

- Vendor Relationships: Timely payments to vendors are crucial for maintaining good relationships. Cash flow forecasting helps hotels prioritize vendor payments, ensuring that essential suppliers are paid promptly.

Dynamics 365 Business Central and Cash Flow Forecasting:

Dynamics 365 Business Central provides powerful tools for cash flow forecasting in hotel financial management:

- Real-Time Data: The solution offers real-time access to financial data, allowing hotels to generate cash flow forecasts based on the latest transaction information.

- Customizable Forecasts: Hotels can customize cash flow forecasts to suit their specific needs, incorporating both short-term and long-term financial projections.

- Integration with Financial Data: Business Central seamlessly integrates cash flow forecasting with other financial data, such as sales, expenses, and accounts receivable/payable. This integration ensures forecast accuracy.

- Scenario Analysis: Hotels can perform scenario analysis within Business Central, exploring different financial scenarios to assess their impact on cash flow. This helps in contingency planning and risk management.

- Automated Alerts: The system can be configured to send automated alerts when cash flow thresholds are breached, providing early warning of potential liquidity issues.

- Historical Analysis: Business Central stores historical cash flow data, enabling hotels to analyze trends and patterns to refine their forecasting models.

In conclusion, Dynamics 365 Business Central's cash flow forecasting tools are indispensable for hotels in the hospitality industry. These tools empower hotels to predict and manage cash flows effectively, ensuring they have the financial resources necessary to operate smoothly, meet obligations, and make strategic financial decisions. By leveraging the capabilities of Business Central, hotels can enhance their financial stability and flexibility in a dynamic industry.

Handling Multi-Currency Transactions

Handling multi-currency transactions is a common necessity for hotels, especially those dealing with international guests and vendors. Dynamics 365 Business Central offers robust capabilities for managing multi-currency transactions, simplifying the process of converting and managing finances in different currencies.

Handling Multi-Currency Transactions in Hotel Financial Management:

- International Guests: Hotels frequently host international guests who may prefer to pay in their home currencies. Multi-currency capabilities enable hotels to accept payments in various currencies, enhancing the guest experience.

- Vendor Payments: Hotels often work with international vendors for various services and supplies. Multi-currency functionality allows hotels to pay vendors in their local currencies, potentially reducing exchange rate-related costs.

- Exchange Rate Management: Business Central provides tools for tracking and managing exchange rates. Hotels can update exchange rates regularly to ensure accurate currency conversions.

- Currency Conversion: The system automatically converts transactions made in foreign currencies into the hotel's base currency, simplifying financial reporting and reconciliation.

- Multi-Currency Accounts: Business Central supports multi-currency bank accounts, allowing hotels to hold funds in different currencies. This feature can help hotels manage foreign currency reserves efficiently.

- Financial Reporting: Multi-currency transactions are seamlessly integrated into financial reporting. Hotels can generate financial statements that reflect transactions in multiple currencies, providing a comprehensive view of financial performance.

- Risk Management: Fluctuations in exchange rates can impact a hotel's financial stability. Multi-currency capabilities enable hotels to monitor and manage currency risk effectively.

Dynamics 365 Business Central and Multi-Currency Transactions:

Dynamics 365 Business Central streamlines the management of multi-currency transactions in hotel financial management in several ways:

- Automatic Conversion: The system automatically converts foreign currency transactions into the hotel's base currency, simplifying the accounting process.

- Exchange Rate Updates: Business Central allows hotels to update exchange rates manually or automatically, ensuring that rates are up-to-date for accurate conversions.

- Multi-Currency Banking: Hotels can maintain bank accounts in different currencies within Business Central, reducing the need for frequent currency conversions and associated fees.

- Real-Time Data: The solution provides real-time access to multi-currency financial data, enabling hotels to make informed decisions based on current exchange rates.

- Financial Transparency: Multi-currency transactions are seamlessly integrated with other financial data in Business Central, providing transparency and accuracy in financial reporting.

- Risk Mitigation: Hotels can use the system to monitor currency risk and implement strategies to mitigate potential losses due to exchange rate fluctuations.

In summary, Dynamics 365 Business Central's multi-currency capabilities are invaluable for hotels dealing with international guests and vendors. These capabilities simplify the handling of foreign currency transactions, from guest payments to vendor settlements, while also providing risk management tools and financial transparency. By leveraging the multi-currency functionality of Business Central, hotels can enhance their financial flexibility and accommodate the needs of a diverse clientele.

Efficient Bank Reconciliation

Efficient bank reconciliation is a critical aspect of hotel financial management, and Dynamics 365 Business Central offers powerful tools to automate and streamline this process. It simplifies reconciling bank statements by matching transactions, identifying discrepancies, and ensuring that a hotel's financial records align with its bank statements.

Efficient Bank Reconciliation in Hotel Financial Management:

- Transaction Matching: Business Central automates the process of matching financial transactions recorded in the hotel's accounting system with those on bank statements. This matching ensures that all transactions are accurately accounted for.

- Discrepancy Detection: The system identifies discrepancies between recorded transactions and bank statements. This includes uncovering missing transactions, duplicate entries, or errors in transaction amounts.

- Timely Reconciliation: Bank reconciliation is typically a time-sensitive task. Business Central enables hotels to reconcile their accounts promptly, reducing the risk of financial discrepancies or oversights.

- Statement Accuracy: Efficient reconciliation ensures that a hotel's financial records accurately reflect its bank statements. This accuracy is essential for financial reporting, compliance, and decision-making.

- Transaction Classification: The solution allows hotels to classify transactions based on their nature (e.g., income, expenses, transfers), making it easier to analyze financial data and prepare reports.

- Audit Trail: Business Central maintains a detailed audit trail of all reconciliation activities, providing transparency and accountability in the reconciliation process.

Dynamics 365 Business Central and Bank Reconciliation:

Dynamics 365 Business Central streamlines and automates the bank reconciliation process for hotels in several ways:

- Automated Matching: The system automates the matching of transactions, reducing manual effort and the potential for errors.

- Data Import: Business Central allows for the import of bank statement data, facilitating the reconciliation process by directly comparing recorded transactions with bank statement entries.

- Clear Documentation: Hotels can attach supporting documents or notes to reconciliation entries, providing context and documentation for each reconciliation.

- Real-Time Data: The solution offers real-time access to financial data, enabling hotels to reconcile their accounts promptly and ensure data accuracy.

- Reporting: Business Central generates reconciliation reports that provide a clear overview of the reconciliation status and any discrepancies found.

- Integration: Reconciliation data seamlessly integrates with other financial data within Business Central, ensuring consistency across all financial records.

In conclusion, Dynamics 365 Business Central's efficient bank reconciliation tools are invaluable for hotels in their financial management efforts. These tools automate and streamline the reconciliation process, improving accuracy, reducing manual effort, and ensuring that financial records align with bank statements. By leveraging Business Central's capabilities, hotels can maintain financial transparency and compliance while saving time and resources in the reconciliation process.

Cheque Writing and Payment Handling

Efficient cheque writing and payment handling are essential in the hospitality industry, and Dynamics 365 Business Central provides tools to streamline these processes. It simplifies cheque writing and payment handling, ensuring that hotels can efficiently pay suppliers, employees, and other stakeholders.

Cheque Writing and Payment Handling in Hotel Financial Management:

- Supplier Payments: Hotels have various suppliers, from food and beverage providers to maintenance services. Business Central simplifies the process of writing and issuing cheques for supplier payments.

- Employee Salaries: Efficient payment handling is critical for paying employee salaries accurately and on time. The system allows for seamless salary payments, including the printing of salary cheques.

- Expense Reimbursements: Hotels often reimburse employees for business-related expenses. Business Central streamlines expense reimbursement processes, ensuring timely payments to employees.

- Vendor Discounts: Managing payment terms and vendor discounts is easier with the system. It enables hotels to take advantage of early payment discounts and optimize cash flow.

- Payment Approval Workflows: Business Central supports payment approval workflows, allowing hotels to define authorization processes for cheque issuance and payments, enhancing control and security.

- Electronic Payments: In addition to cheque writing, the solution supports electronic payments and direct debit options, providing flexibility in payment methods.

Liked what you just read? Sharing is caring.

October 08, 2023 by Frédéric Charest by Frédéric Charest VP of Marketing

Data-driven Growth Marketer with a Passion for SEO - Driving Results through Analytics and Optimization