Financial reporting is a cornerstone of effective association management. Associations, whether they are nonprofit organizations, trade groups, or professional societies, rely on accurate and timely financial information to make informed decisions, demonstrate transparency to members, and ensure compliance with regulatory requirements. However, the traditional approach to financial reporting, which often involves manual data entry and complex spreadsheets, can be a cumbersome and error-prone process.

In this digital age, associations have a powerful ally in their pursuit of efficient financial reporting: accounting software. Accounting software designed specifically for associations offers a wide range of tools and features that can simplify the financial reporting process, making it more accurate, efficient, and accessible.

In this article, we will explore how accounting software can revolutionize financial reporting for associations. We will delve into the various ways in which accounting software streamlines tasks, enhances data accuracy, and provides valuable insights into an association's financial health. Whether you're a small nonprofit organization or a large industry association, understanding the benefits of accounting software is crucial for optimizing your financial management.

Before we delve into the specifics, let's take a moment to consider the challenges that associations often face when it comes to financial reporting and why traditional methods can fall short in meeting these challenges effectively.

The Importance of Financial Reporting for Associations

Financial reporting serves several critical purposes for associations:

- Decision-Making: Association leaders need up-to-date financial data to make informed decisions. This data helps them allocate resources, set budgets, and plan for the future. Without accurate and timely financial information, associations may make decisions based on guesswork rather than data-driven insights.

- Transparency: Members and stakeholders demand transparency in financial matters. Associations are accountable to their members, donors, and regulatory bodies, and they must demonstrate how funds are managed and used. Transparent financial reporting fosters trust and confidence among members.

- Compliance: Many associations are subject to regulatory requirements that mandate accurate financial reporting. Failure to comply with these regulations can result in penalties and damage an association's reputation.

- Stakeholder Communication: Associations often need to communicate financial information to their members, board of directors, donors, and external partners. Effective financial reporting ensures that stakeholders are well-informed about an association's financial health and activities.

Now that we've established the importance of financial reporting, it's time to explore how accounting software can help associations overcome the challenges associated with manual processes and simplify their financial reporting efforts. In the sections that follow, we will discuss the specific features and benefits of accounting software tailored to the unique needs of associations.

Understanding the Role of Accounting Software

Now that we've recognized the vital role of financial reporting for associations, it's essential to understand how accounting software fits into this equation. Accounting software is a digital tool designed to automate, streamline, and optimize various financial management tasks. While it's widely used across industries, specialized accounting software for associations takes into account the unique needs and challenges faced by these organizations.

What Is Accounting Software?

At its core, accounting software is a digital platform that helps organizations manage their financial transactions, recordkeeping, and reporting processes. It replaces traditional manual accounting methods, such as ledgers and spreadsheets, with automated solutions that offer greater efficiency and accuracy.

Here are some key functions of accounting software:

- Transaction Recording: Accounting software allows you to record financial transactions such as income, expenses, and transfers in a structured and organized manner. It eliminates the need for manual entry, reducing the risk of errors.

- Data Categorization: The software categorizes transactions into different accounts, making it easier to track income and expenses across various categories, such as membership dues, event revenue, and operating costs.

- Real-time Updates: Many accounting software solutions provide real-time updates, ensuring that your financial data is always current. This feature is especially valuable for associations that need immediate access to financial information for decision-making.

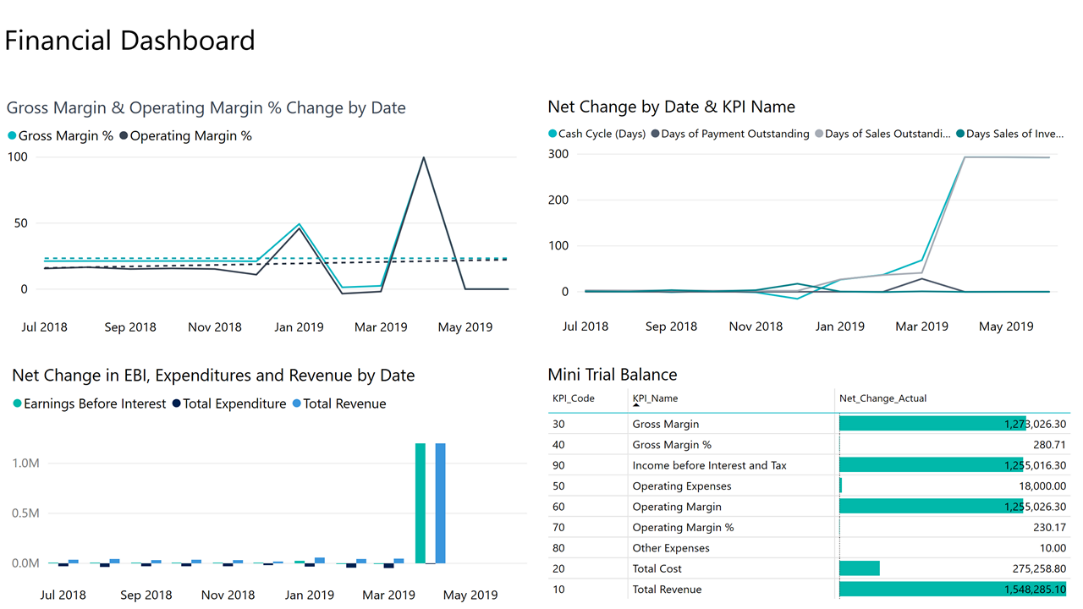

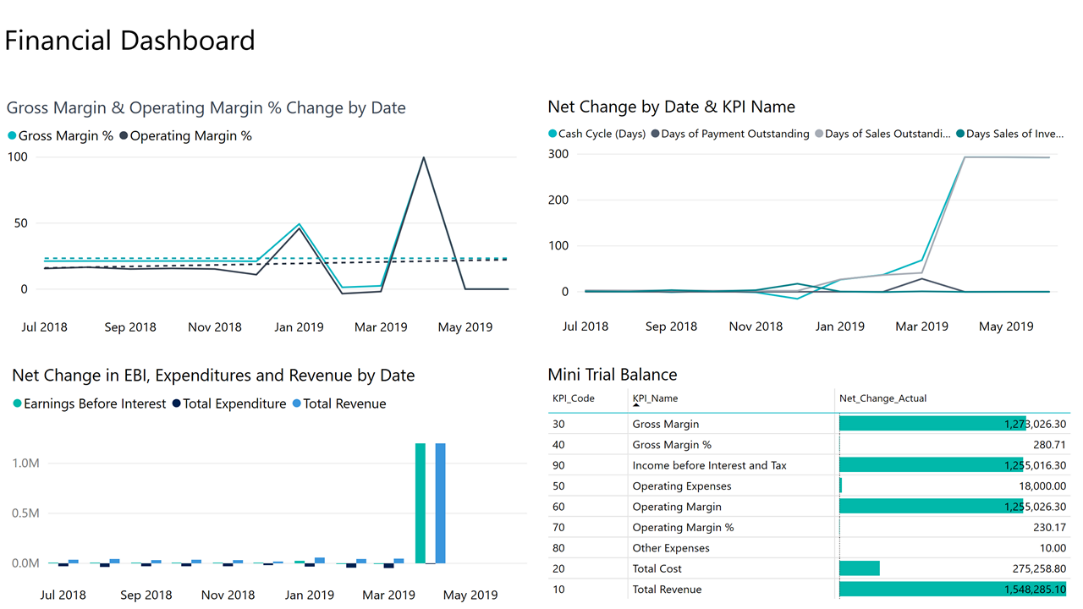

- Financial Reporting: Accounting software generates standard financial reports like balance sheets, income statements, and cash flow statements. These reports offer insights into an association's financial health, performance, and trends.

- Budgeting and Forecasting: Some accounting software platforms include budgeting and forecasting tools, helping associations plan for the future and make informed financial decisions.

How Accounting Software Differs for Associations

While general accounting software can be used by a wide range of businesses and organizations, accounting software tailored to associations offers unique advantages. These solutions are designed with the specific needs and challenges of associations in mind, making them a valuable tool for streamlining financial reporting processes. Here's how accounting software for associations differs:

- Membership Integration: Association-specific accounting software often integrates seamlessly with membership management systems. This integration allows for the automatic syncing of membership data with financial records, simplifying tasks like dues tracking and revenue attribution.

- Compliance Features: Many associations must adhere to specific regulatory requirements and reporting standards. Association accounting software is often equipped with compliance features to help organizations meet these obligations efficiently.

- Customization: Associations have diverse financial needs, and their reporting requirements can vary widely. Specialized software allows for customization, enabling associations to create reports tailored to their unique goals and objectives.

- Collaboration: Collaboration is essential within associations, and accounting software can facilitate it by allowing multiple users to access and work on financial data simultaneously. This feature enhances transparency and teamwork.

In the sections that follow, we'll dive deeper into the ways in which accounting software simplifies financial reporting for associations. From streamlining data entry to providing real-time financial insights, you'll discover how these tools can revolutionize your association's financial management processes.

Sreamlining Data Entry and Recording

One of the most significant challenges associations face when it comes to financial reporting is the manual entry and recording of financial transactions. This process can be time-consuming, error-prone, and resource-intensive, especially for associations with a high volume of transactions. Fortunately, accounting software comes to the rescue by streamlining data entry and recording in several ways:

- Automated Data Entry: Accounting software automates the process of data entry, reducing the need for manual input. This automation can save countless hours that would otherwise be spent entering data into spreadsheets or ledgers. Automation not only speeds up the process but also minimizes the risk of human errors, which can have significant consequences for an association's financial accuracy.

- Importing Transactions: Many accounting software solutions allow you to import financial transactions directly from bank accounts, credit cards, or other sources. This means you can link your association's bank accounts to the software and have transactions automatically imported and categorized. This feature eliminates the need to manually enter every income and expense, making financial reporting faster and more accurate.

- Reducing Data Entry Errors: Manual data entry is prone to errors, and even a small mistake can have a ripple effect on an association's financial records. Accounting software employs built-in validation checks and algorithms to catch and correct errors in real-time. This proactive approach to error prevention ensures that your financial data remains accurate and reliable.

By automating data entry and recording, accounting software not only simplifies the process but also frees up valuable time and resources that can be better allocated to other essential tasks within your association. Furthermore, the reduction in errors enhances the integrity of your financial data, a critical factor for transparent and reliable financial reporting.

In the next section, we'll explore how accounting software excels in automated transaction categorization, ensuring that your association's financial data is accurately organized and easily accessible for reporting purposes.

Automated Transaction Categorization

Efficient financial reporting relies on accurately categorizing transactions. Association finances involve various income sources, expenses, and funds allocated for specific purposes. Accounting software simplifies this task through automated transaction categorization:

1. How Software Simplifies Categorization:

Accounting software employs sophisticated algorithms and machine learning to automatically categorize transactions based on predefined rules and patterns. For example, it can recognize that a deposit from a specific member should be categorized as membership dues, or that a payment to a venue is an event expense. As transactions are imported or entered, the software assigns appropriate categories, saving you time and ensuring consistency.

2. The Benefits of Accurate Categorization:

Accurate transaction categorization is pivotal for creating meaningful financial reports. It allows you to track income and expenses by specific categories, providing insights into which areas of your association's finances are thriving and where adjustments may be needed. This level of granularity is invaluable for informed decision-making, budgeting, and financial planning.

Furthermore, precise categorization simplifies compliance and audit preparation. When transactions are organized correctly, it's easier to demonstrate to auditors and regulatory bodies that your financial records are accurate and in compliance with reporting standards.

By leveraging automated transaction categorization, accounting software not only streamlines the financial reporting process but also enhances the quality of the reports generated. This ensures that your association can present a clear and accurate financial picture to stakeholders, members, and auditors.

In the upcoming sections, we'll continue to explore how accounting software provides real-time access to financial data, generates standard financial reports, and customizes reports to meet your association's unique needs. These features contribute to a more efficient and insightful financial reporting process.

Real-time Financial Data

Timeliness is a critical aspect of financial reporting, especially for associations that need to make swift decisions, respond to member inquiries, or address financial concerns promptly. Accounting software excels in providing real-time access to financial data:

1. Instant Access to Financial Information:

Accounting software keeps your association's financial data up-to-date in real-time. This means you can access your current financial status, account balances, and transaction details at any moment. This level of immediacy empowers association leaders and financial managers with the information they need, exactly when they need it.

2. Making Informed Decisions:

With real-time financial data at your fingertips, you can make informed decisions with confidence. Whether it's deciding on budget allocations, authorizing expenditures, or assessing the financial impact of a new initiative, having access to current financial information enables more agile and effective decision-making.

Moreover, real-time data is particularly beneficial for associations that host events, manage sponsorships, or engage in fundraising activities. It allows you to track revenue, expenses, and progress toward financial goals in real-time, helping you adjust strategies as needed to meet your objectives.

The ability to access financial data instantly is a substantial advantage in the fast-paced world of association management. Accounting software eliminates the lag time associated with manual data entry and reconciliation, ensuring that you have the most current financial information available.

In the upcoming section, we'll explore how accounting software simplifies the generation of standard financial reports, providing you with valuable insights into your association's financial health and performance. These reports are essential tools for effective financial reporting and decision-making.

Generating Standard Financial Reports

Standard financial reports are the backbone of financial reporting for associations. These reports provide a comprehensive overview of an association's financial health, performance, and stability. Accounting software simplifies the process of creating these reports:

- Balance Sheets: A balance sheet is a snapshot of your association's financial position at a specific point in time. It lists your assets, liabilities, and equity. Accounting software compiles data from your transactions and accounts to generate balance sheets instantly. This helps you understand your association's financial stability and whether it has more assets than liabilities.

- Income Statements: Income statements, also known as profit and loss statements, detail your association's revenues, expenses, and net income or loss over a specific period. Accounting software calculates these figures automatically, allowing you to track your association's financial performance over time.

- Cash Flow Statements: Cash flow statements provide insight into how money flows in and out of your association. This report is crucial for managing cash reserves and ensuring your association can meet its financial obligations. Accounting software can generate cash flow statements, helping you identify periods when cash may be tight or when surplus funds are available.

- Budget vs. Actual Reports: Comparing your budgeted figures to actual results is essential for financial planning and accountability. Accounting software allows you to create budget vs. actual reports effortlessly. These reports highlight areas where your association is exceeding or falling short of its financial goals, enabling you to make adjustments as necessary.

The automation of standard financial reports not only saves time but also enhances accuracy. Human error, a common concern in manual reporting, is significantly reduced when using accounting software. This means you can rely on these reports with confidence when communicating with board members, members, donors, and auditors.

In the next section, we'll explore how accounting software can be customized to meet your association's specific reporting needs, providing flexibility and tailored insights that go beyond standard reports. Customization is a powerful feature for associations with unique financial requirements.

Customizing Reports for Association Needs

While standard financial reports provide essential insights into an association's financial health, associations often have unique reporting requirements. Accounting software offers the flexibility to customize reports to meet these specific needs:

1. Tailoring Reports to Association Goals:

Association goals and objectives can vary widely. Whether your association focuses on membership growth, event management, or fundraising, you can customize reports to align with your goals. For example, you can create reports that track membership dues by category, event profitability, or grant funding utilization.

2. Creating Specialized Reports:

In addition to standard financial reports, accounting software allows you to design specialized reports that provide a deeper understanding of your association's finances. These reports can include detailed breakdowns of expenses, revenue sources, or financial performance by program or department. The ability to create custom reports empowers associations to track the metrics that matter most to them.

Customization extends beyond the content of reports. Accounting software often provides options for adjusting the format, layout, and visual elements of reports. This means you can tailor reports to match your association's branding and communication style.

Customized reports are valuable for both internal and external stakeholders. They enable association leaders to track progress toward specific goals and provide members, donors, and partners with detailed insights into how their contributions are making an impact.

In the next section, we'll explore how accounting software simplifies compliance and audit preparation for associations. Regulatory compliance is crucial for maintaining the trust of members and stakeholders, and accounting software can play a pivotal role in ensuring accuracy and transparency.

Simplifying Compliance and Audit Preparation

Associations, like many organizations, must adhere to specific regulatory requirements and reporting standards. Failure to comply with these regulations can lead to penalties and damage an association's reputation. Accounting software plays a critical role in simplifying compliance and audit preparation:

1. Maintaining Accurate Records:

Accurate financial recordkeeping is fundamental to regulatory compliance. Accounting software ensures that transactions are recorded accurately, reducing the risk of errors that could result in compliance issues. With every transaction automatically categorized and tracked, you have a complete and precise record of your association's financial activities.

2. Facilitating External Audits:

Many associations undergo external audits to verify the accuracy of their financial statements and compliance with regulations. Accounting software streamlines the audit process by providing auditors with access to organized, digital records. This simplifies their job and can lead to more efficient and cost-effective audits.

3. Ensuring Regulatory Compliance:

Accounting software designed for associations often includes features specific to regulatory compliance. It can generate reports and documentation required for compliance with nonprofit or association-specific regulations. This ensures that your association remains in good standing with regulatory bodies and maintains the trust of its members and stakeholders.

By simplifying compliance and audit preparation, accounting software reduces the administrative burden associated with regulatory requirements. It also enhances the accuracy and transparency of financial reporting, which is vital for associations committed to upholding high standards of governance and accountability.

In the next section, we'll explore how accounting software enhances collaboration and transparency within associations. These features are crucial for effective communication and decision-making among association leaders, members, and stakeholders.

Enhancing Collaboration and Transparency

Collaboration and transparency are essential elements of successful association management. Accounting software plays a pivotal role in fostering collaboration among association leaders, members, and stakeholders while enhancing transparency in financial matters:

1. Sharing Financial Data with Stakeholders:

Accounting software allows you to easily share financial data with key stakeholders, including board members, committee chairs, members, and donors. You can provide controlled access to specific reports or financial information, ensuring that stakeholders are well-informed about the association's financial health and activities.

2. Collaborative Features of Accounting Software:

Modern accounting software often includes collaborative features that enable multiple users to work together on financial data. Team members can input data, review reports, and discuss financial matters within the software itself. This collaborative environment promotes transparency and efficient teamwork.

3. Real-time Updates for Transparency:

Real-time financial data accessibility means that stakeholders can view the association's financial status at any time. Whether it's a board meeting, committee discussion, or member inquiry, having up-to-the-minute financial information available enhances transparency and builds trust.

Transparency is not just a matter of compliance; it's a cornerstone of good governance. Members and donors want to know that their contributions are being used responsibly, and transparent financial reporting demonstrates accountability and commitment to the association's mission.

In the next section, we'll explore the benefits of integrating accounting software with Membership Management Software, such as Legio. This integration can further streamline financial reporting for associations by connecting financial data with membership data, providing a holistic view of association operations.

Integration with Membership Management Software

Integrating accounting software with Membership Management Software, like Legio, can significantly enhance the efficiency of financial reporting for associations. This integration creates a seamless connection between financial data and membership data, offering a holistic view of association operations. Here's how it benefits associations:

1. Streamlining Membership Data and Financials:

Integration between accounting and membership management software ensures that membership-related financial transactions, such as dues collection, renewals, and event fees, are automatically recorded and categorized correctly in your accounting system. This reduces manual data entry, minimizes errors, and ensures that financial reports accurately reflect the financial impact of membership activities.

2. Enhanced Reporting Insights:

By integrating the two systems, associations can generate reports that provide deeper insights into the financial aspects of membership management. For example, you can easily track revenue generated from different membership tiers, analyze membership trends, and determine the financial impact of membership growth or attrition.

3. Improved Member Communication:

Integration allows for better member communication by providing real-time financial updates. Members can receive statements, invoices, and receipts directly from the integrated system, enhancing their understanding of financial transactions and promoting transparency.

4. Simplified Reconciliation:

Reconciliation between membership data and financial records becomes more straightforward when using integrated systems. This ensures that membership fees and contributions align accurately with your financial statements, making audits and financial reporting smoother processes.

The integration of accounting software with Membership Management Software streamlines financial processes and reduces the potential for errors associated with manual data transfer. It allows associations to manage their finances and memberships seamlessly, leading to better financial reporting and a more cohesive view of association operations.

In the next section, we'll explore how associations can choose the right accounting software for their specific needs and considerations to keep in mind during the selection process. Making the right choice is crucial for a successful financial reporting strategy.

Choosing the Right Accounting Software for Your Association

Selecting the right accounting software for your association is a crucial decision. The software you choose should align with your specific needs, goals, and operational requirements. Here are some key considerations when choosing accounting software:

- Association Size and Complexity: Consider the size and complexity of your association. Smaller associations with straightforward financial needs may find basic accounting software sufficient, while larger and more complex organizations may require advanced features and scalability.

- Integration Capabilities: As we've discussed earlier, integration with other systems, such as Membership Management Software, can be highly beneficial. Ensure that the accounting software you choose supports the integrations you require to streamline data sharing between systems.

- Regulatory Compliance: If your association is subject to specific regulatory requirements, look for accounting software that offers compliance features tailored to your industry or region. This ensures that you can easily meet regulatory obligations.

- Reporting Flexibility: Evaluate the software's reporting capabilities. Can it generate standard financial reports, customize reports to meet your specific needs, and provide real-time access to financial data? Reporting flexibility is essential for robust financial reporting.

- User-Friendliness and Training: Consider the user-friendliness of the software and the availability of training and support. An intuitive interface and comprehensive training resources can help your team adopt and use the software effectively.

- Cost and Budget: Determine your budget for accounting software. Costs can vary significantly depending on the features and scalability you require. Consider both upfront costs and ongoing subscription or licensing fees.

- Security and Data Protection: Ensure that the software prioritizes data security and protection. Your association's financial data is sensitive, and it's vital to choose software with robust security measures in place.

- Customer Support and Updates: Check the availability of customer support and the frequency of software updates. Reliable support ensures that you can address any issues or questions promptly, while regular updates keep your software current and secure.

- User Feedback and Reviews: Research user feedback and reviews from other associations or organizations that use the software. Their experiences can provide valuable insights into the software's strengths and weaknesses.

Taking the time to assess these considerations will help you make an informed decision when selecting accounting software for your association. Remember that the right software can significantly simplify financial reporting, streamline operations, and enhance transparency.

In the final section, we'll discuss the steps involved in implementing accounting software in your association and the importance of training and support to ensure a smooth transition.

Implementing Accounting Software in Your Association

Implementing accounting software in your association is a pivotal step towards simplifying financial reporting and enhancing financial management. To ens

Liked what you just read? Sharing is caring.

October 22, 2023 by Frédéric Charest by Frédéric Charest VP of Marketing

Data-driven Growth Marketer with a Passion for SEO - Driving Results through Analytics and Optimization