Chapter 1: The Need for Accounting Software in Hotels

The hospitality industry is a complex and dynamic field, where providing exceptional guest experiences is paramount. Behind the scenes, however, hoteliers face a unique set of challenges, especially when it comes to financial management. In this chapter, we'll explore the critical need for accounting software in hotels, shedding light on the difficulties inherent to the industry's financial landscape and how technology can help overcome them.

Challenges in Hotel Financial Management

Running a hotel involves numerous financial transactions on a daily basis. From managing room bookings, handling restaurant and bar tabs, tracking housekeeping and maintenance expenses, to payroll, the financial aspects of hotel operations are intricate. This complexity is further exacerbated by seasonal fluctuations in occupancy rates, varying pricing strategies, and the need to maintain high standards of service regardless of economic conditions.

Traditionally, hotel accounting has relied heavily on manual processes and spreadsheets. While these methods may have sufficed in the past, they are increasingly proving inadequate for the demands of the modern hotel industry. Here are some of the challenges faced by hoteliers relying on traditional accounting methods:

1. Inefficiency and Human Error

Manual data entry and spreadsheet-based accounting are prone to errors. The volume of financial transactions in hotels makes it easy for mistakes to creep in, leading to inaccurate financial records and potential financial losses.

Challenges:

- Manual Data Entry: In many hotels, financial data is entered manually into spreadsheets or accounting ledgers. This process is time-consuming and susceptible to human error. Staff members may mistype numbers, transpose figures, or forget to record transactions.

- Complex Transactions: Hotels engage in a wide range of financial transactions daily. These can include room bookings, restaurant and bar sales, event bookings, payroll, supplier invoices, and more. Managing these transactions manually can become overwhelming, especially during peak seasons.

- High Volume of Data: Hotels handle a high volume of data, from guest reservations to daily revenue streams. Managing this data manually or with basic spreadsheet tools can quickly become unmanageable, increasing the likelihood of errors.

Examples:

- Room Reservation Errors: Imagine a scenario where a hotel receptionist mistakenly records a guest's reservation for the wrong date. The guest arrives, expecting a room, only to find there's no reservation for them. This results in guest dissatisfaction and potential revenue loss if the hotel is fully booked.

- Incorrect Billing: Inaccurate billing is a common problem when manual data entry is involved. For instance, a restaurant server may input incorrect prices for items on a guest's bill. This not only leads to revenue discrepancies but can also damage the hotel's reputation if guests notice the errors.

- Payroll Mistakes: Manual payroll processing is prone to errors, such as incorrect hours worked or miscalculated employee benefits. These errors can lead to overpayments, underpayments, or compliance issues with labor laws.

- Supplier Invoices: When managing supplier invoices manually, there's a risk of overlooking or duplicating payments. For example, a hotel might accidentally pay the same invoice twice, leading to unnecessary expenses.

Impact:

Inefficiency and human error in hotel financial management can have several significant consequences:

- Financial Losses: Errors in billing, reservations, or payroll can result in financial losses. These losses may go unnoticed until they accumulate or are discovered during financial audits.

- Guest Dissatisfaction: Mistakes in reservations, billing, or service charges can lead to guest dissatisfaction. Unhappy guests may leave negative reviews, impacting the hotel's reputation and future bookings.

- Operational Delays: Manual data entry and error correction take time and can delay financial reporting and decision-making. This delay can be particularly problematic when quick responses are needed, such as during emergencies or market fluctuations.

- Compliance Risks: Errors in tax calculations, reporting, or compliance with industry regulations can lead to legal and financial consequences, including fines and penalties.

To address these challenges, hotels are increasingly turning to accounting software solutions that automate data entry, provide real-time transaction tracking, and offer error-checking mechanisms. These software tools not only reduce the risk of errors but also improve the overall efficiency of financial processes, leading to more accurate financial records and better decision-making.

2. Lack of Real-Time Visibility

Traditional accounting methods often result in delayed financial reporting. Hotel managers need real-time insights into revenue, expenses, and profitability to make informed decisions. Waiting for weeks to generate reports can lead to missed opportunities and inefficiencies.

Challenges:

- Delayed Financial Reporting: Traditional accounting methods, especially those reliant on manual data entry and paper-based processes, often lead to delays in generating financial reports. This delay can range from days to weeks, making it challenging for hotel managers to access up-to-date financial information.

- Incomplete Picture: Without real-time visibility into revenue, expenses, and profitability, hotel managers may make decisions based on outdated or incomplete data. This can result in missed opportunities to optimize operations, adjust pricing strategies, or allocate resources effectively.

- Inefficiencies: Delayed financial reporting can lead to inefficiencies in resource allocation. For example, if a hotel is experiencing unexpectedly high demand for a particular service or product, managers may not be aware of it until weeks later, leading to missed revenue potential.

Examples:

- Pricing Adjustments: Imagine a hotel that hosts events and conferences in its banquet facilities. Without real-time data on occupancy rates, event bookings, and competitors' pricing, the hotel may miss the opportunity to adjust its pricing for event packages during peak seasons. This could result in lost revenue or unfulfilled demand.

- Inventory Management: In the restaurant and bar areas of a hotel, inventory management is critical. If these areas don't have real-time visibility into which items are selling well and which are slow-moving, they may overstock or run out of popular menu items, impacting both revenue and customer satisfaction.

- Cost Control: Hotels have various cost centers, including housekeeping, maintenance, and staff scheduling. Lack of real-time visibility into these areas can make it challenging to control costs effectively. For example, without up-to-date data on staff scheduling and occupancy rates, a hotel might overstaff during low-demand periods, leading to unnecessary labor costs.

- Revenue Recognition: Delayed revenue recognition can affect financial planning and decision-making. If a hotel can't recognize revenue from booked reservations until weeks later, it may face challenges in managing cash flow and making investment decisions.

Impact:

The lack of real-time visibility in hotel financial management can have several significant consequences:

- Missed Revenue Opportunities: Delays in recognizing trends or changes in demand can result in missed revenue opportunities. Hotels may underprice or overprice their services, leading to either revenue loss or lost business.

- Inefficient Resource Allocation: Without real-time insights, hotels may allocate resources inefficiently, resulting in higher costs or missed cost-saving opportunities.

- Customer Dissatisfaction: Guests may experience service delays or issues when hotels cannot respond promptly to changes in demand or guest preferences. This can lead to customer dissatisfaction and negative reviews.

- Competitive Disadvantage: Hotels that lack real-time visibility may be at a competitive disadvantage. Competitors who can adjust their pricing, services, and operations in real time are better positioned to attract guests and optimize revenue.

To address these challenges, hotels are turning to accounting software solutions that offer real-time transaction tracking, customizable dashboards, and reporting capabilities. These software tools provide hotel managers with immediate access to financial data, enabling informed decisions, proactive adjustments, and improved overall operational efficiency.

3. Complex Expense Tracking

Hotels have a wide range of expenses, from utilities and payroll to inventory and guest services. Tracking and categorizing these expenses manually can be time-consuming and error-prone, making it challenging to identify cost-saving opportunities.

Challenges:

- Diverse Expense Categories: Hotels incur expenses in a wide range of categories, including utilities, payroll, inventory, guest services, maintenance, marketing, and more. Each category may have its own set of subcategories, making manual tracking complex and time-consuming.

- Manual Data Entry: Tracking and categorizing expenses manually can be error-prone. Staff members may inadvertently assign expenses to the wrong category or misplace receipts, leading to inaccuracies in financial records.

- Missed Cost-Saving Opportunities: In the absence of efficient expense tracking, hotels may struggle to identify cost-saving opportunities. For example, they may not notice patterns of wasteful spending or may miss opportunities to negotiate better supplier contracts.

Examples:

- Utility Expenses: Hotels have high utility expenses, including electricity, water, and heating/cooling. Tracking and managing these expenses manually can result in overpayments due to incorrect meter readings or missed opportunities to optimize energy consumption.

- Payroll: Payroll is one of the largest expenses for hotels. Managing staff scheduling, tracking hours worked, and calculating overtime manually can lead to errors in employee paychecks and compliance issues with labor laws.

- Inventory and Supply Costs: Hotels must manage inventory for their restaurants, bars, and guest amenities. Without efficient tracking, they may overstock perishable items, leading to food waste, or run out of essential supplies, causing service disruptions.

- Guest Services Expenses: Expenses related to guest services, such as housekeeping and maintenance, need to be carefully tracked to ensure efficient allocation of resources. Manual tracking may result in overstaffing during low-demand periods or delayed maintenance requests.

Impact:

Complex expense tracking challenges in hotel financial management can have several significant consequences:

- Increased Costs: Manual expense tracking can lead to overpayments, inefficiencies, and missed opportunities to negotiate better terms with suppliers, resulting in increased costs.

- Inaccurate Financial Reporting: Errors in expense tracking can result in inaccurate financial reports, making it challenging for hotel managers to make informed decisions.

- Operational Inefficiencies: Inefficient resource allocation, such as overstaffing or understocking, can impact service quality and operational efficiency.

- Compliance Risks: Errors in payroll and labor cost tracking can lead to non-compliance with labor laws, potentially resulting in legal issues and financial penalties.

To address these challenges, hotels are turning to accounting software solutions that automate expense tracking and categorization. These software tools can capture expense data from various sources, such as receipts and invoices, and categorize them accurately, providing hotel managers with real-time insights into their expenses and enabling better cost control and decision-making.

4. Compliance Challenges

The hotel industry is subject to various regulations and tax requirements that vary by location. Staying compliant with these regulations can be a daunting task, especially when relying on manual processes that may not be equipped to handle evolving legal requirements.

Challenges:

- Complex Regulatory Environment: The hotel industry is subject to a complex web of regulations that can vary significantly by location. These regulations cover areas such as occupancy taxes, tourism taxes, labor laws, environmental standards, and safety codes. Keeping up with the changing legal landscape can be challenging.

- Manual Processes: Relying on manual processes for compliance, such as tax calculations, reporting, and record-keeping, can be error-prone and time-consuming. Human errors or outdated procedures may result in non-compliance, leading to legal issues and financial penalties.

- Location-Specific Requirements: Compliance requirements often differ from one jurisdiction to another. A hotel with multiple locations or properties in different regions must navigate a patchwork of regulations, each with its own unique demands.

Examples:

- Occupancy Taxes: Many jurisdictions impose occupancy taxes on hotel stays. These taxes can vary not only by location but also by factors like the length of stay and room rate. Manually calculating and collecting these taxes for each guest can be prone to errors, leading to underreporting or overcharging.

- Labor Laws: Labor laws can differ widely, impacting matters such as minimum wage, overtime pay, and employee benefits. Ensuring compliance with these laws for a diverse workforce in the hotel industry can be a complex task, particularly when managing payroll manually.

- Environmental Regulations: Hotels are often subject to environmental regulations related to energy usage, waste management, and water conservation. Compliance with these regulations may require ongoing monitoring and reporting, which can be challenging to achieve manually.

- Safety Standards: Hotels must adhere to safety standards for guests and employees. Compliance involves inspections, documentation, and maintenance of safety equipment. Failure to meet safety standards can result in legal liabilities.

Impact:

Compliance challenges in hotel financial management can have several significant consequences:

- Financial Penalties: Non-compliance with tax and regulatory requirements can lead to fines, penalties, and legal expenses, increasing operating costs.

- Reputation Damage: Failing to meet safety or environmental standards can damage a hotel's reputation, potentially leading to negative reviews and decreased bookings.

- Operational Disruptions: Legal disputes and compliance issues can disrupt daily operations and divert resources away from core activities.

- Competitive Disadvantage: Hotels that struggle with compliance may face a competitive disadvantage compared to competitors who can navigate the regulatory landscape more effectively.

To address these challenges, hotels are turning to accounting software solutions that offer configurable compliance rules and automation for tax calculations and reporting. These solutions help ensure that financial operations align with local laws and regulations, reducing the risk of non-compliance and associated consequences.

Why Traditional Methods Fall Short

The limitations of traditional accounting methods in the hotel industry are clear. They hinder operational efficiency, accuracy, and the ability to adapt to the ever-changing hospitality landscape. As hotels strive to enhance guest experiences and remain competitive, addressing these limitations becomes essential.

The Role of Technology in Addressing These Challenges

Enter accounting software designed specifically for hotels. These solutions are tailored to meet the unique needs of the industry, offering a range of features and benefits that go beyond what traditional methods can provide.

In the following chapters, we'll delve deeper into the world of hotel accounting software, exploring how to choose the right solution for your hotel, implement it effectively, and leverage its capabilities to streamline financial processes, enhance accuracy, and drive cost savings. Join us on this journey to discover how technology is transforming the way hotels manage their finances, and how it can be a game-changer for your establishment.

Chapter 2: Choosing the Right Accounting Software

In the previous chapter, we discussed the significant challenges that hotels face in their financial management processes and how traditional methods often fall short. Now, let's dive into the crucial process of selecting the right accounting software for your hotel. This decision can have a profound impact on your financial efficiency, accuracy, and overall operational success.

Factors to Consider When Selecting Accounting Software

Choosing the right accounting software is not a one-size-fits-all endeavor. Different hotels have varying needs and requirements, and the software you select should align with your specific goals and operations. Here are some key factors to consider during the selection process:

1. Hotel Size and Scale

The size and scale of a hotel impact various aspects of financial management, including the volume and complexity of financial transactions, the number of employees, and the overall scope of operations. Consequently, the choice of accounting software should align with these specific needs. Here's how hotel size and scale can influence accounting software requirements:

- Volume of Financial Transactions: Larger hotels, such as resorts or chains with multiple properties, typically handle a higher volume of financial transactions compared to small boutique hotels. Accounting software for larger hotels needs to be able to efficiently process and manage a larger number of transactions.

- Complexity of Operations: Larger hotels often have diverse revenue streams, including accommodations, restaurants, bars, event spaces, and more. The software should be capable of handling the complexity of managing different revenue sources, inventory management, and labor allocation.

- Multi-Entity Considerations: For hotel chains or groups with multiple properties, multi-entity accounting capabilities become crucial. This allows for the consolidation of financial data from various locations into a unified view, streamlining reporting and analysis.

Examples:

- Small Boutique Hotel: A small boutique hotel may have a limited number of rooms and revenue streams, making its financial operations relatively straightforward. In this case, accounting software tailored for small businesses can be a cost-effective and practical choice.

- Mid-sized Hotel: A mid-sized hotel may have a larger number of rooms, a restaurant, and event spaces. It needs accounting software that can handle a moderate volume of financial transactions and manage inventory and payroll efficiently.

- Large Resort: A large resort, especially one with multiple restaurants, bars, shops, and extensive guest amenities, deals with a high volume of financial transactions and complex operations. It requires robust accounting software with advanced features like inventory management, multi-entity support, and detailed financial reporting.

- Hotel Chain: A hotel chain with multiple properties in different locations requires accounting software capable of consolidating financial data from various entities. This ensures that financial reporting can be done at both individual property and group levels.

Impact:

The impact of hotel size and scale on accounting software choice can be substantial:

- Efficiency: Choosing software that matches the size and complexity of your hotel's operations can improve efficiency in financial management, reducing the time and effort required for tasks like data entry and reporting.

- Accuracy: Tailored software can help minimize errors in financial records, which become more critical as the scale of operations increases.

- Cost Considerations: Smaller hotels may prioritize cost-effective solutions that meet their specific needs, while larger hotels may be willing to invest in more advanced software with a broader feature set.

- Scalability: Consider whether the chosen software can scale with your hotel's growth. It should accommodate an increase in transactions, properties, or revenue streams without major disruptions.

In summary, the size and scale of your hotel are key factors in determining the most suitable accounting software. It's essential to assess the specific needs and operations of your hotel to choose software that optimally supports your financial management requirements.

2. Integration Capabilities

Modern hotels operate in a highly interconnected digital landscape, relying on various software systems to manage different aspects of their operations. These systems include Property Management Systems (PMS) for reservations and guest management, Point-of-Sale (POS) systems for restaurants and bars, and other specialized software for tasks like inventory management and customer relationship management. Integration capabilities in accounting software are crucial for several reasons:

- Seamless Data Flow: Integration allows for the seamless flow of data between different software systems. For example, when a guest checks out of a hotel room, the data should seamlessly transfer from the PMS to the accounting software to update revenue records without manual intervention.

- Minimized Manual Data Entry: Manual data entry is time-consuming and prone to errors. Integration automates data transfer, reducing the risk of data entry mistakes and freeing up staff to focus on more valuable tasks.

- Real-Time Insights: Integration enables real-time access to financial data. Hotel managers can make informed decisions and monitor performance without waiting for data to be manually inputted and processed.

- Comprehensive Reporting: Integrated systems provide a holistic view of the hotel's financial health. Managers can generate comprehensive reports that encompass data from various departments and systems, aiding in strategic decision-making.

Example: Integration with Dynamics 365 Business Central and LS Central for Hotel

Let's consider an example to illustrate the importance of integration capabilities:

Imagine a large resort hotel that uses Microsoft Dynamics 365 Business Central for accounting and LS Central for Hotel as its Property Management System. LS Central for Hotel manages room reservations, check-ins, and guest services, while Dynamics 365 Business Central handles financial accounting.

Integration between these two systems is essential:

- When a guest checks into a room at the resort, LS Central for Hotel should automatically update the guest's folio with room charges and other incidentals.

- At the end of the guest's stay, when they check out, the system should seamlessly transfer all charges and payment information to Dynamics 365 Business Central for accurate revenue recognition.

- If the resort has a restaurant and bar, the POS system in use should also integrate with both the PMS and accounting software to ensure that all guest charges are accurately reflected in the financial records.

This integration ensures that revenue and expense data flows smoothly, reducing the risk of errors, providing real-time insights, and enabling the hotel to maintain accurate financial records.

Impact:

The impact of integration capabilities in hotel accounting software can be significant:

- Efficiency: Integration reduces the need for manual data entry and reconciliation, improving operational efficiency and reducing the risk of errors.

- Timeliness: Real-time data flow allows for timely decision-making and financial reporting, which is crucial for monitoring and optimizing hotel performance.

- Data Accuracy: Automated data transfer reduces the risk of data entry errors, ensuring that financial records are accurate and reliable.

- Comprehensive Insights: Integrated systems provide a holistic view of the hotel's financial performance by combining data from various sources, aiding in strategic planning and forecasting.

In summary, integration capabilities in hotel accounting software are vital for streamlining operations, improving accuracy, and gaining real-time insights into financial performance. When choosing accounting software, hotels should consider its compatibility with existing systems, such as PMS and POS, to ensure a seamless flow of data across their entire operation.

3. Reporting and Analytics

Comprehensive reporting and analytics are essential for understanding your hotel's financial performance. Look for software that provides customizable reports, real-time dashboards, and forecasting tools to help you make data-driven decisions. Comprehensive reporting and analytics capabilities are critical for hotel financial management for several reasons:

- Informed Decision-Making: Access to customizable reports and real-time dashboards enables hotel managers to make informed decisions based on up-to-date financial data. This is crucial for adjusting strategies, optimizing operations, and addressing challenges promptly.

- Financial Transparency: Robust reporting tools promote financial transparency within the organization. Staff and stakeholders can easily access financial information, promoting accountability and trust.

- Forecasting and Planning: Hotels can use forecasting tools to project future revenue, expenses, and occupancy rates. This aids in setting realistic financial goals, allocating resources, and planning for growth.

- Performance Monitoring: Regular monitoring of key performance indicators (KPIs) through analytics helps hotels track their financial health. It allows them to identify trends, spot anomalies, and take corrective actions when necessary.

- Compliance and Audit: Reporting capabilities assist hotels in maintaining compliance with tax regulations and industry standards. They provide the necessary documentation for audits and regulatory reporting.

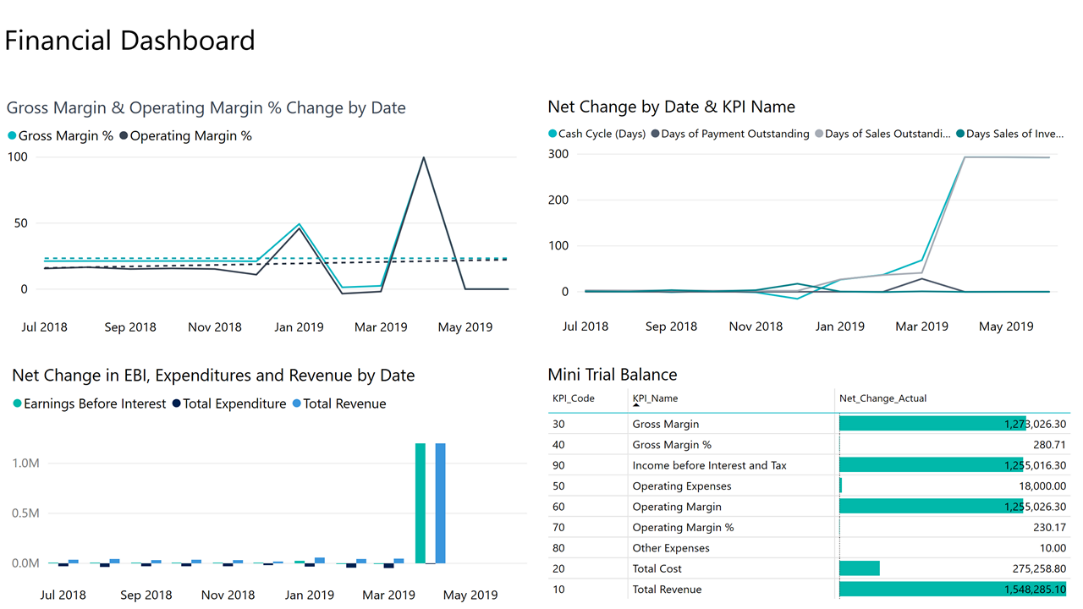

Example: Integration with Power BI in Dynamics 365 Business Central

Let's use an example to highlight the importance of reporting and analytics:

Suppose a luxury hotel chain uses Microsoft Dynamics 365 Business Central as its accounting software. This solution offers built-in integration with Power BI, a powerful business intelligence tool. Here's how this integration can benefit the hotel:

Liked what you just read? Sharing is caring.

October 12, 2023 by Frédéric Charest by Frédéric Charest VP of Marketing

Data-driven Growth Marketer with a Passion for SEO - Driving Results through Analytics and Optimization